About Us

Experience Real Tax Solutions

From Stanlee Tax Resolutions!

For 20+ years, StanLee Tax Resolutions has turned the tables on the IRS, using expert and insider insight to dismantle their aggressive tactics. It’s time to take control and resolve your back taxes with us.

828-799-7826

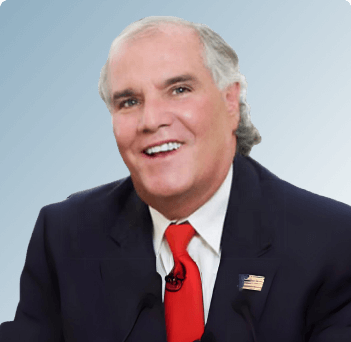

Shanon Stanbury

MBA, EA President & Tax Expert

Introducing

The Founder of StanLee Tax Resolutions, Shanon Stanbury

Shanon Stanbury’s path to establishing StanLee Tax Resolutions was driven by her financial challenges. After facing difficulties firsthand, she realized that conventional accounting practices weren’t sufficient for individuals in tough situations like hers. With 20+ years of experience and an MBA in Accounting, she was motivated to create a firm that offers much more than standard services.

Now, StanLee Tax Resolutions places your financial concerns as its top priority. Shanon’s commitment is to transform tax-related problems into clear solutions, guiding you through complex scenarios toward a more stable and successful future.

Your All-in-One Financial Solution

From general accounting to advanced tax resolution, we offer a full suite of services designed to simplify all the paperwork for you:

- General accounting services

- Tax planning and resolution

- Business management and consulting

- Payroll management

- IRS Representation

The Faces Who Work Hard To Resolve Your Tax Problems!

MBA, EA President,

StanLee Enterprises, LLC

Tax Mananger

Office Manager

Staff Accountant

Former IRS Agent, Teaching Instructor,Fox & ABC News Contributor

Certified Public Accountant | IRS Problem-Solving Expert

ESQ, Tax Attorney

Former IRS Criminal Investigator

EA, Former IRS Revenue Officer & IRS Appeals Settlement Officer

Former IRS Appeals Officer and Revenue Agent

Former IRS Revenue Officer

Former IRS Appeals Agent & California State Agent

Staff Accountant

Alison Gentry

Apprentice

Our Mission

We’re here to help you through every step. No hidden fees, no surprises—just clear, reliable support so you can focus on your business and life. From handling severe IRS tax problems to offering sound financial advice right when you need it most, we’re your dependable partner for tax relief and business consulting

Our Vision

We strive to be the leading name in tax resolution, delivering solutions that inspire trust, reflect integrity, and prioritize your needs. As the tax landscape evolves, we stay ahead with innovative strategies that simplify your journey. Our mission is to empower individuals and businesses to overcome tax challenges with confidence, turning obstacles into opportunities for financial growth. Because when tax issues are resolved, nothing stands in the way of your success.

Values That Guide Us

Clients First, Always

Your success is our priority. No matter how complex the challenge, we’re dedicated to safeguarding your financial well-being and delivering results that bring you peace of mind.

Accountability in Action

We take ownership of every step we take. Transparency, reliability, and unwavering commitment define our approach, ensuring you can trust us to resolve your tax challenges with integrity.

Turning Challenges into Solutions

We see every tax issue as an opportunity to create a path forward. By addressing challenges head-on, we deliver practical solutions that restore control and confidence in your financial future.

Empathy and Understanding

We recognize the stress that tax challenges bring. With compassion and a deep understanding of your situation, we’re here to guide and support you every step of the way toward resolution.

The longer you delay, the bigger your tax troubles grow!

Don’t let the stress and penalties pile up. We’re here to fix it before it’s late. Let’s tackle this now and get you back on solid ground!

Don’t Go It Alone

We’re Here to Help

Dealing with tax issues can be overwhelming, but you don’t have to face them by yourself. We’re here to make the process easier, to answer your questions, and to fight for the best possible outcome. Whether you’re feeling lost or just need a bit of guidance, we’ve got your back every step of the way.

Still Don’t Believe Us?

Listen to What Our Clients Say!

The sweetest person I’ve met lately. Shannon is a straight shooter and helped me boost my confidence level just a little bit more! Amazing person and client of my company as well!

Justin Triplett

I worked with Shanon for years before she started her business. Always professional in everything she does. She’s handled my taxes for several years- would highly recommend!!

Lajeana Lovelace

Highly recommend StanLee enterprises! One stop shop for all your accountant needs!

Timmy Mosier

Excellent service on an older tax issue between states. Resolved without angst thanks to Shanon. Professional, courteous, responsive and most of all, helpful. Strongly recommended!

Boyd Austin III

Our Blog

Latest Our Blog

Contact Us

StanLee Tax Resolutions offers the support and solutions you need. Our team can help you tackle even the toughest tax problems—simply reach out to get started.